** Home

|

-- Government - New Jersey TaxesGovernment * Governor * Legislature * Courts * Counties * Municipalities * Taxes * Politics/elections * Political history * Lobbyists -- Overview

The legal authority to impose taxes in New Jersey is derived from the 1947 State Constitution and implementing laws codified in Title 54 of the New Jersey Statutes Annotated (hereafter N.J.S.A.). The collection of state taxes is the responsibility of the Department of the Treasury, primarily through its Division of Taxation (tax filing, processing and collection) and its Division of Revenue and Enterprise Services (business registration and tax payment services). For most of its history, the state lacked a statewide general tax, relying largely on revenues from railroad taxes and fees, a variety of business levies and sales of state property such as tidelands. In the nineteenth century, the state's efforts to avoid taxing its residents resulted in its being derided as the "state of the Camden and Amboy" for the corrupt influence of the dominant railroad monopoly on state government. Toward the end of the nineteenth century, New Jersey was branded by the muckraking journalist Lincoln Steffens as the "traitor state" for its weak corporate regulation intended to attract trusts and monopolies to establish their legal domiciles in the state in return for fees which again allowed the state government to avoid taxing its own citizens. It was not until the 1950s that the state enacted a sales tax--its first statewide tax on the general public. After failed attempts in the 1960s by both Governor Hughes and Governor Cahill, the state became one of the last to enact an income tax, which was signed by Governor Byrne in 1976. The income tax was approved only after the state Supreme Court ordered the closing of public schools, placing intense pressure on the legislature to force passage of the tax. Even after the additional revenues provided by the income tax, New Jersey local governments remain heavily dependent, compared to most states, on their taxation of real estate in financing schools and local government operations, New Jersey completed the phaseout of its estate tax in 2018 and reduced its sales tax rate from 6.875% to 6.625%, completing a two-year revision which also imposed higher gas tax rates. (Some municipalities have 'Urban Enterprise Zones' where qualifying sellers may collect and remit sales tax at a 3.3125% rate, half the 6.625% statewide rate). At the same time, however, a new individual income tax bracket with a rate of 10.75% was created, the third-highest in the country, along with a corporate income tax surcharge on companies with income of $1 million or more, raising their tax rate to 11.5%--.the highest statutory corporate tax rate of all states followed by Pennsylvania (9.99%) and Iowa and Minnesota (both at 9.8%). Despite critics who contended the state's high tax rates on upper-income residents would drive relocations to lower-tax states, the number of millionaires in New Jersey increased by 5.4% from 2019 to 2020. According to IRS data, 23,950 tax returns were filed in New Jersey with $1 million or more in adjusted gross income in 2020, up from 22,720 the prior year. In comparison to 2015. New Jersey had a 22.3% increase.

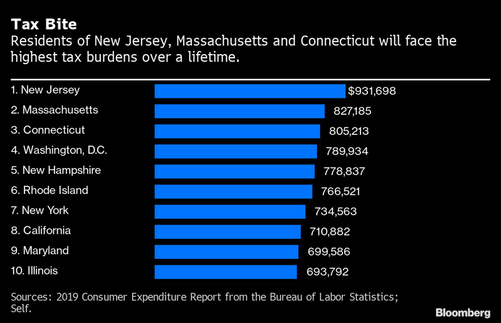

-- Tax Revenues and Tax Burden A study released in May 2021 reported that New Jerseyans pay on average a grand lifetime total in all federal, state and local taxes of $931,698, the highest tax burden of all states, ahead of #2 Massachusetts at $827,185 and #3 Connecticut at $805,213. Nationwide, taxpayers pay $525,037 over their lives, which includes taxes on income, property, cars and retail spending, according to the report.. According to the report released in 2021 by the nonprofit Tax Foundation based in Washington, D.C., the most recent national state tax burden comparisons (for calendar year 2019) showed New Jersey with the seventh highest tax burden with 11.7% of income required to pay state and local taxes and ,$8,134 per person in its population behind New York with the highest burden of 14.1% of income and $9,987 per capita. The national average for all states was $4,420 per capita and 9.9% of total income. The state also ranked highest of all states in property tax collections per capita in fiscal year 2018 at $3,378, ahead of New Hampshire ($3,362), Connecticut ($3,107) and New York ($3,025), and compared to the average for all states of $1,675 per capita. In 2020, according to data from the State Department of Community Affairs, property taxes in the state averaged $8,161 per home, a 2.2% increase over the level of the previous year. Over 70% of state appropriations flow through state government in the form of state aid to local governments or grants-in-aid (in general, direct state services to the public, with the bulk of the funds for school support). Executive Operations (the cost of running the state government) is approximately 10% of the budget. Debt Service (excluding school construction, which is a form of state aid) is approximately 8% of the budget. On all federal taxes, the Internal Revenue Service reported that in fiscal year 2018 (the most recent data available as of January 2023) New Jersey corporate and individual taxpayers paid $62.8 billion in taxes (6th highest of all states behind #1 California at $234.5 billion). with its per capita payments of $9,028 (4th highest behind Connecticut $10,328; Massachusetts $9,793; and New York $9,078). New Jersey consistently ranks as one of the states with the lowest return of funds from the federal government compared to federal taxes paid by state corporate and individual taxpayers; A study of how much states paid in total federal taxes compared to what they received in federal payments from such programs as social security, transportation and other aid based on 2018 data, reported that the states with the highest net losses in payments compared to receipts were New York, which paid in US taxes $22 billion more than it received; New Jersey, which paid $12 billion more; Massachusetts, which paid $9 billion more; and Connecticut, which paid $8 billion more than it received. * IRS Statistics of Income Data Book * Filing Taxes after Moving, MyMove.com

|

|

|

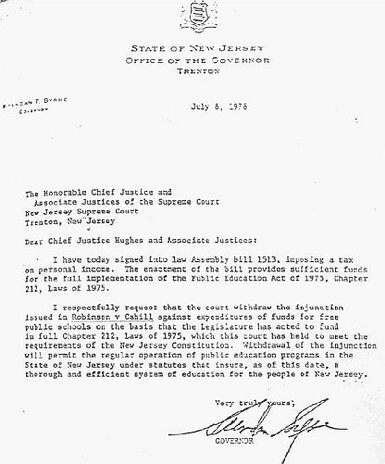

-- Gross income tax (N.J.S.A. 54:A:1-1 et seq.) The state personal income tax was enacted in 1976 during the administration of Governor Brendan Byrne, with its revenues dedicated by constitutional amendment to support public schools and to provide property tax relief. The tax was approved only after earlier income tax proposals by Governors William Cahill and Richard Hughes failed to pass in the legislature. The 1976 legislation gained passage after the New Jersey Supreme Court, in its Robinson v. Cahill decision, held that the state's system of relying on the local property tax as the primary revenue source for financing public education was in conflict with the state government's responsibility under the 1947 Constitution to provide a "thorough and efficient" education for all students. After the legislature failed to enact an adequate school funding source within the deadlines set by the decision, the Court ordered all schools closed commencing on July 1, 1976, subsequently vacating the order on July 8 after the legislature passed and Governor Byrne signed legislation establishing the tax. The dedicated revenues from the income tax now account for approximately 40% of all state government revenues. In a subsequent series of decisions, collectively known as Abbott v. Burke, the state Supreme Court further defined the extent of the state's obligation to finance education in the poorest school districts, which became known as "Abbott districts." Income taxes from residents are based on brackets depending upon filing status. Single taxpayers and married taxpayers filing separately:

* Income Tax Resource Center, NJ Division of Taxation * Individual Income Tax Rates by State 2021, Federation of Tax Administrators * NJ State Taxes 2020-21, Forbes.com * Robinson v. Cahill, Justia.com

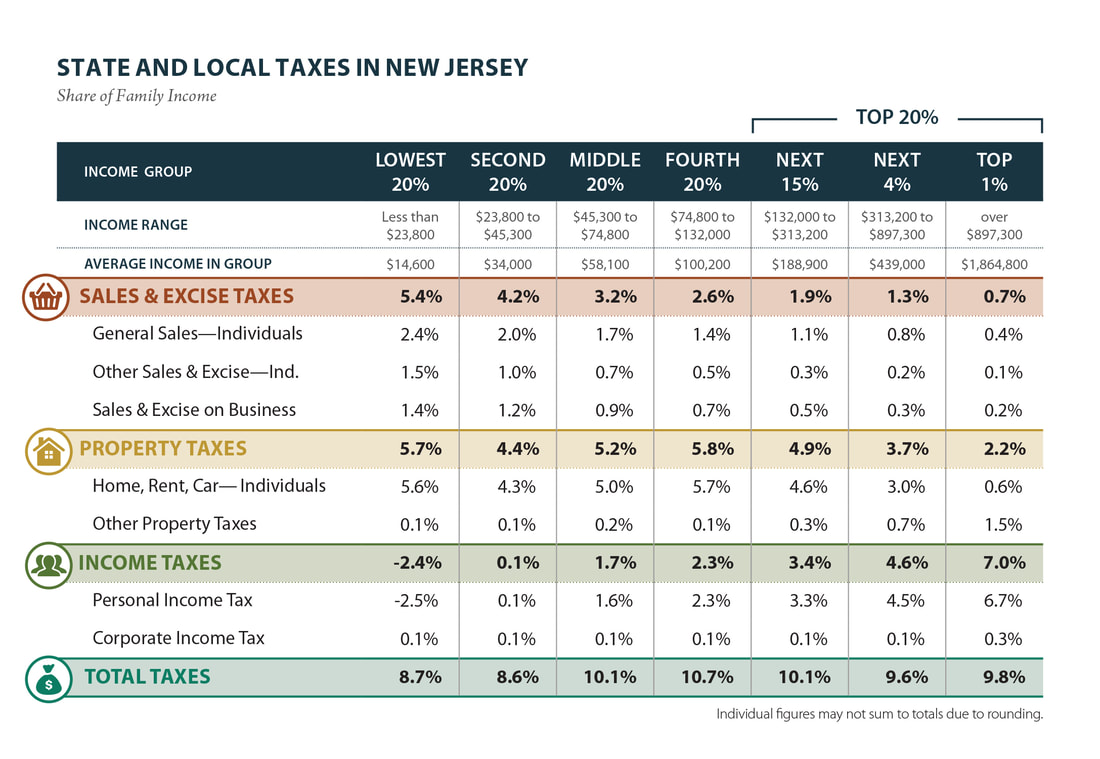

Local Property Tax (N.J.S.A. 54:4-1 et seq.) In 2022, according to data from the state Department of Community Affairs, New Jersey's average residential property tax bill was $9,490, an increase of about 2.2% over 2021. The total tax levy in 2022 was nearly $32 billion, including $17 billion for public schools; $9.56 billion to support municipal budgets and other local services; and $5.68 billion to support county government spending. Property owners in Essex County paid the highest average property taxes in the state in 2022, with the typical bill rising by more than $120 to $13,053. Other counties with average bills above $10,000 were Bergen, $12,522; Union, $12,253; Morris, $11,303; Passaic, $10,662; Hunterdon, $10,600; Somerset, $10,580; and Monmouth, $10,142. The highest average property tax bills in 2021 were reported in Millburn ($24,485); Demarest ($$21,983),Mountain Lakes ($21,625), Tenafly ($21,966); Mountain Lakes ($21,868); Glen Ridge ($21,647), Rumson ($21,591), and Alpine ($21,498).. School taxes in 2021 rose 2.3%, compared with 1.6% for county taxes and 1.3% for municipal taxes. The annual rate of growth in the size of the average New Jersey property-tax bill for 2022 was consistent with a trend over the last decade since New Jersey’s 2% statutory cap on annual property-tax levy increases went into effect in 2011. Local property-tax bills have grown by no more than 2.4% year-over-year since the 2% cap went into effect in 2011. According to an NJ Spotlight News analysis released in February 2022, the average property-tax bill in 2021 would have been roughly $12,800, compared to the actual level of $9,284, if the bills had grown over the last decade at the same rate they did during the decade before the 2% cap became law in 2011. In recent years, school taxes have accounted for slightly over half of the total property tax bill. On average, municipalities spend 53% of their revenues on schools, with the remainder going to such expenses as police, public works, waste collection, recreation and administration. The second largest area of local government spending was for police, approximately 40% of local budgets; a study by NJ Advance Media released in January 2022 reported that the average police officer made $123,239 in 2019, the most recent year before the disruption of the pandemic. Despite its overall tax burden, a recent study by the Washington, D.C.-based Institute on Tax and Economic Policy has credited New Jersey for maintaining a tax system that doesn’t exacerbate the already wide gap between the highest and lowest income groups. The study determined that New Jersey’s lowest-income families pay taxes at lower rates than all other groups of taxpayers. All real property located in the state is subject to property tax on the basis of its market value unless specifically exempted by statute. Exemptions include property owned by the state and local government and public authorities, as well as property dedicated to qualified religious, charitable, educational and healthcare uses. Limited exemptions or abatements are also provided to developments in designated urban renewal projects authorized by municipal governing bodies. Qualified farmland is taxed based upon its productive capabilities when actively devoted to agricultural or horticultural uses. The assessed valuation of real property is based on 100% of its fair market value, which is defined as what a willing, knowledgeable buyer would pay a willing, knowledgeable seller on the open market at a bona fide sale as of the statutory October 1 pretax year assessment date. The tax on the property is then calculated by multiplying the general tax rate by the assessed value of the particular property. Real property taxes are assessed and collected by the assessors and collectors of the respective municipalities but are subject to supervision and review by the county boards of taxation. Assessments may be appealed by taxpayers to the board of taxation in each county, and a judgment of the tax board may be further appealed to the Tax Court of New Jersey. Successful appeals require demonstrating that the tax bill is at least 15% higher than the value of the property. * Property Tax Information, NJ Department of Community Affairs * NJ property taxes rose again in 2022, NJSpotlightNews.org. * NJ’s property taxes: Four key charts show where and how fast, 1/22/2022, NJSpotlightNews.org * Ten years in NJ property taxes: Rising, but kept (somewhat) in check, 2/14/2022, NJSpotlightNews.org * The true cost of policing, 1/20/2022, NJ.com * A Guide to Tax Appeal Hearings, NJ Department of the Treasury County, municipal and school budget costs determine the amount of property tax to be paid. A municipality's general tax rate is calculated by dividing the total dollar amount it needs to raise to meet its share of the county budget and it own budget expenses by the total assessed value of all its taxable property. Property tax payments are due annually in four installments payable on February 1, May 1, August 1 and November 1. The state also provides various special property tax relief programs for senior citizens, disabled persons and veterans which, subject to eligibility standards and income levels, may offer credits, rebates or freezes on property taxes. Legislation enacted in 2021, designated as the ANCHOR program (Affordable New Jersey Communities for Homeowners and Renters), allows homeowners making up to $150,000 to receive $1,500 rebates on their property tax bills, and those making $150,000 to $250,000 to receive $1,000 rebates. Renters making up to $150,000 will receive $450 checks to help offset rent increases associated with property taxes. * New Jersey State Constitution of 1947 * Property Tax Information, New Jersey Department of Community Affairs * Who Pays? Institute for Taxation and Economic Policy Effective in the 2018 tax year, as part of a broad overhaul of the federal tax code enacted by President Donald Trump and the Republican Congress, the federal deduction for state and local taxes (known as "SALT"), prohibited homeowners from deducting more than $10,000 in property taxes and state income taxes from their federal taxable income. In reaction to the federal cap, the state’s own deduction limit for property taxes was increased by state lawmakers to $15,000.

|

|

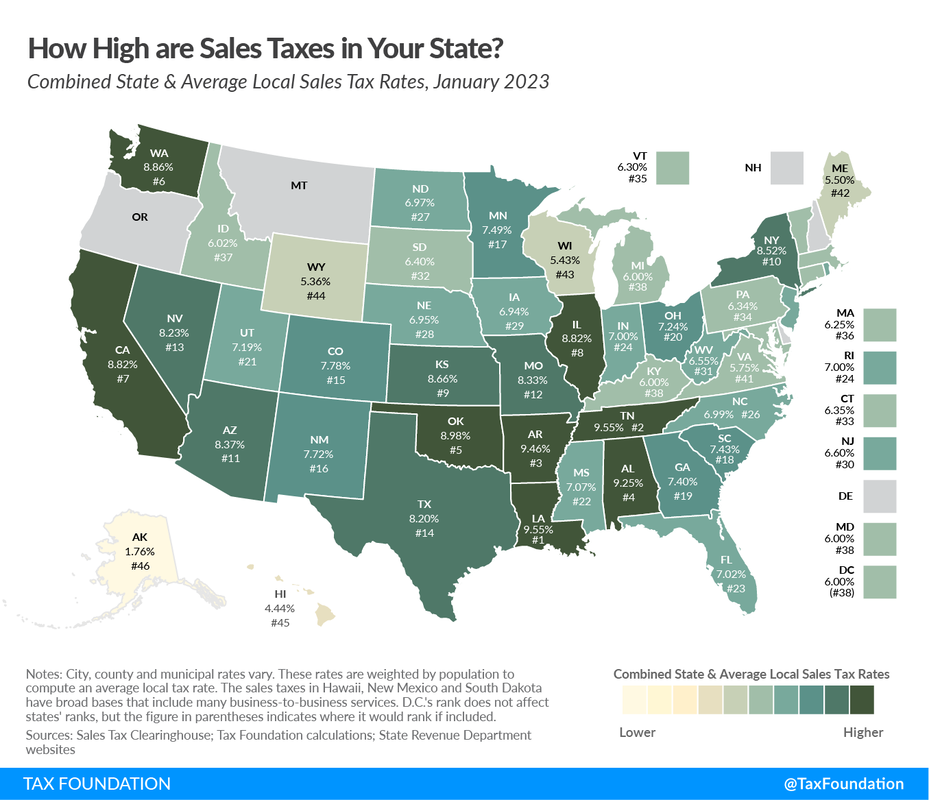

-- Sales and use tax (N.J.S.A. 54:32B-1 et seq.)

Effective January 1, 2018, the New Jersey Sales and Use Tax Rate was lowered to 6.625% from the prior rate of 6.825%. All retail sales are taxable unless specifically exempt by law. Current exemptions include most food items for at-home preparation, prescription medications, clothing (except fur items), footwear, utility charges such as for electricity, gas, water, steam and fuel, and disposable paper products such as toilet paper for use in the home. The state also has established 32 Urban Enterprise Zones covering sections within 37 economically distressed cities in which retailers who are annually approved by the local Urban Enterprise Authority are allowed to charge half the regular tax rate, and also have the right to purchase items (excluding motor vehicles) and most services without paying sales taxes on their purchases. Apart from the sales tax, a compensating use tax is also imposed when taxable goods and services are purchased, including items bought on the Internet, and New Jersey sales tax is either not collected or is collected at a rate less than New Jersey's sales tax rate. |

|

-- Alcoholic Beverage Tax (N.J.S.A. 54:43-1 et seq.)

The Alcoholic Beverage Tax Act imposes taxes on alcoholic beverages, in addition to the regular sales tax, at a rate of $5.50 per gallon for hard liquor; $0.875 per gallon for wine; and $0.12 per gallon for beer. The Alcoholic Beverage Tax is paid by manufacturers, wholesalers and other persons licensed by the Division of Alcoholic Beverage Control. Retail licenses are authorized and issued by municipalities of New Jersey. -- Cigarette Tax (N.J.S.A. 54:40A-1 et seq.) A tax is imposed on the sale, use or possession for sale or use within New Jersey of all cigarettes. As of 2015, the tax rate is $2.70 per pack, the ninth highest rate among all states. License fees are payable by distributors, wholesalers, manufacturers, retailers and vending machine retailers. A separate Tobacco Products Wholesale Sales and Use Tax is imposed on sales of all tobacco products (excluding cigarettes as defined in N.J.S.A 54:40A-2) by a wholesaler or distributor. -- Motor Fuels Tax (N.J.S.A. 54:39-1 et seq.) Effective in October 2016, New Jersey's motor fuels tax was increased by 23 cents per gallon, going from 14.5 cents to 37.5 cents per gallon. The tax applies to sales of gasoline, diesel fuel or liquefied petroleum gas and compressed natural gas used in motor vehicles on public highways. A separate Motor Fuels Use Tax (N.J.S.A. 54:39A-1 et seq.) imposes a fuel use tax on certain commercial and omnibus vehicles based on the amount of motor fuels used in their operations within New Jersey and is administered by the New Jersey Division of Motor Vehicles. -- Inheritance and estate tax (N.J.S.A. 54:34-2)

In accordance with legislation signed by Governor Christie in October 2014, New Jersey's estate tax was repealed for decedents dying on or after January 1, 2018 and the exclusion amount was increased from $675,000 to $2,000,000 for decedents dying on or after January 1, 2017. Prior to the new law, New Jersey had been one of the few states imposing both an estate tax on the assets of decedents and an inheritance tax on beneficiaries receiving real or personal property from the estate of a decedent. Currently, the law imposes a graduated inheritance tax ranging from 11% to 16% on the transfer of real and personal property with an aggregate value of $500 or more to certain beneficiaries. Beneficiaries exempt from the inheritance tax are father, mother, grandparents, wife, husband, civil union partner, child or husband, civil union partner, child or children of a decedent, adopted child or children of a decedent, issue of a child or legally adopted child of a decedent, mutually acknowledged child, stepchild (includes a grandchild and great-grandchild but not a stepgrandchild or a great-stepgrandchild), and domestic partner. Those not exempt are taxable at 15% for the first $700,000 and at 16% for amounts above $700,000. For decedents dying prior to the effective dates of the statute phasing out the estate tax, estates with assets of $675,000 or more were taxed at rates commencing at 37% on the first $52,174 over the exemption with lower rates on larger estates ranging from 4.8% to 16%. -- Corporation Business Tax (N.J.S.A. 54:10A-1 et seq.) and Corporation Income Tax (N.J.S.A. 54:10E-1 et seq.) The Corporation Business Tax Act imposes a franchise tax on a domestic corporation for the privilege of existing as a corporation under New Jersey law, and on a foreign corporation for the privilege of having or exercising its corporate charter in the state or doing business, employing or owning capital or property, maintaining an office, deriving receipts, or engaging in contracts in New Jersey. The tax applies to all domestic corporations and all foreign corporations having a taxable status unless specifically exempt. The tax also applies to joint-stock companies or associations, business trusts, limited partnership associations, financial business corporations, and banking corporations, including national banks. Also, a corporation is defined as any other entity classified as a corporation for federal income tax purposes and any state or federally chartered building and loan association or savings and loan association. For C Corporations with Entire Net Income greater than $100,000, the tax rate is 9% (.09) on adjusted entire net income or such portion thereof as may be allocable to New Jersey. For taxpayers with Entire Net Income greater than $50,000 and less than or equal to $100,000, the tax rate is 7.5% (.075) on adjusted entire net income or such portion thereof as may be allocable to New Jersey. Tax periods of less than 12 months qualify for the 7.5% rate if the prorated entire net income does not exceed $8,333 per month. For taxpayers with Entire Net Income of $50,000 or less, the tax rate is 6.5% (.065) on adjusted net income or such portion thereof as may be allocable to New Jersey. For S Corporations with total entire net income that is not subject to federal income taxation or such portion thereof as may be allocable to New Jersey, there shall be no rate of tax imposed. For taxpayers with total entire net income plus nonoperational income with New Jersey Nexus, greater than $50,000 and less than or equal to $100,000, the applicable tax rate for entire net income that is subject to federal corporate taxation is 7.50% (.075). Tax periods of less than 12 months qualify for this reduced rate if the prorated amount of entire net income plus nonoperational income with New Jersey Nexus does not exceed $8,333 per month. For taxpayers with total entire net income plus nonoperational income with New Jersey Nexus of $50,000 or less, the tax rate for entire net income that is subject to federal corporate taxation is 6.5% (.065).Tax periods of less than 12 months qualify for the 6.5% rate if the prorated if the prorated amount of entire net income plus nonoperational income with New Jersey Nexus does not exceed $4,166 per month. The minimum tax is $375 for adjusted net income or such portion thereof allocable to New Jersey below $100,000, rising to $1,500 for taxpayers with $1 million and over. ; * Corporation Business Tax, NJ Division of Taxation -- Banking and Financial Corporations Tax (N.J.S.A. 54:10A-1 et seq.) Banking and financial corporations are subject to the Corporation Business Tax Act at the rate of 9% on net income or to the lesser rates stated above if their income meets those thresholds. -- Other taxes In addition to the above taxes, New Jersey also imposes various taxes for special purposes. These include the Spill Compensation and Control Act (N.J.S.A. 58:10-23.11 et seq.) imposed upon the transfer by major facilities or vessels of petroleum products and other hazardous substances within New Jersey, as determined by the New Jersey Department of Environmental Protection; Petroleum Products Gross Receipts Tax on the gross receipts derived or gallons sold from the first sale of imported petroleum products made to points in New Jersey for sale or consumption within New Jersey; Tobacco Products Wholesale Sales and Use Tax is imposed on sales of all tobacco products (excluding cigarettes as defined in N.J.S.A 54:40A-2) by a wholesaler or distributor; Solid Waste Services Tax (N.J.S.A. 13:1E-138a) levied on the owner or operator of every sanitary landfill facility in New Jersey on all solid waste accepted in a landfill; Landfill Closure and Contingency Tax (N.J.S.A. 13:1E-100 et seq.)is levied upon the owner or operator of every sanitary landfill facility located in New Jersey on all solid waste accepted for disposal; Litter Control Tax (N.J.S.A 13:1E-99.1) on all gross receipts from wholesale sales and on all gross receipts from retail sales of litter-generating products sold within or into New Jersey by each person engaged in business in the State as a manufacturer, wholesaler, distributor or retailer of such products. |

|

Government * Governor * Legislature * Courts * Counties * Municipalities * Taxes * Politics/elections * Political history * Lobbyists |