-- Government - Overview

Government

* Governor * Legislature * Congress * Courts * Counties

* Municipalities * Taxes * Politics/elections

* Political history * Lobbyists

|

* Home

* History * Population * Government * Politics * Lobbyists * Taxes * State Symbols * Biographies * Economy * Employers * Real Estate * Education * Recreation * Restaurants * Hotels * Health * Environment * Stadiums/Teams * Theaters * Historic Villages * Historic homes * Battlefields/Military * Lighthouses * Art Museums * History Museums * Wildlife * Climate * Zoos/Aquariums * Beaches * National Parks * State Parks * Amusement Parks * Waterparks * Swimming holes * Arboretums More... * Gallery of images and videos * Fast Facts on key topics * Timeline of dates and events * Anthology of quotes, comments and jokes * Links to other resources * |

New Jersey is comprised of the state government with an executive branch headed by the governor; a legislature of a 40-member Senate and 80-member General Assembly; and a judiciary with the highest court the Supreme Court of seven justices headed by the chief justice. There are 21 counties and 565 municipalities; unlike some states, New Jersey has no unincorporated areas and municipalities cover its entire geographic area. Most school districts are formed to serve individual municipalities, but there are also regional, consolidated and countywide districts, as well as non-operating school districts which do not operate any school facilities but administer sending-receiving relationships under which students attend school in other districts under contractual agreements.

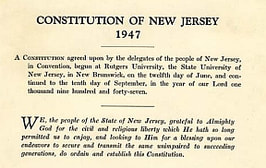

Beginning of state Constitution. Image: New Jersey State Archives Beginning of state Constitution. Image: New Jersey State Archives

- State Constitution

New Jersey's current state constitution was adopted in 1947 and is the third constitution following those adopted in 1776 and 1844. The primary reasons for adopting the 1947 constitution were to strengthen the role of the governor; consolidate state executive agencies; and restructure the courts under the central administration of the state Supreme Court and its chief justice. The constitution may be amended by approval of a majority of voters at a general election after both houses of the legislature have voted to place the proposed amendment on the ballot. A proposed amendment for submission to the voters can be passed either by simple majority in two separate legislative sessions, or by a 60% supermajority vote taken in one session. The governor's approval is not required for submission of the question for voter consideration. Unlike several states, New Jersey does not allow proposed constitutional amendments to be submitted for referendum through petition by voters without prior approval by the legislature. * New Jersey State Constitution of 1947, NJ State Archives * Proceedings of the 1947 Constitutional Convention, NJ State Library * The New Jersey State Constitution by Robert F. Williams (2012) * New Jersey State Constitutions 1776, 1844 and 1947, NJ State Archives -- Government employees According to the US Census Bureau's most recent American Community Survey conducted in 2021, New Jersey had a total of 424,337 full-time state, county and local government employees, The total state government payroll was $859.8 million and local government was $2.1 billion, according to the survey. * American Community Survey, US Census Bureau * Public Sector Jobs: States where the most people work for government, 6/1/2018, USA Today -- Government Revenue, Spending, Workforce and Debt Total New Jersey state government revenue anticipated in fiscal year 2025 (7/1/2024-6/30/2025) was estimated at $54.1 billion. Total state spending was projected at $55.9 billion. The total state-funded workforce for fiscal 2025 was estimated at 43,232, with an additional 22,519 positions funded by non-state sources, principally the federal government. The state ranked 25th of all states in 2022 for the number of all public employees at 509 per 10,000 population. New Jersey's State and Local Government Total Spending ranked by:percent of Gross Domestic Product ranked 25th highest of all states in fiscal 2023 at 10.13% of GDP, compared to the average of all states at 9.77%. The spending total ranked seventh of all states, behind California; New York; Texas; Pennsylvania; Ohio; and Florida. Total debt of the state government and state authorities as of June 30, 2023, was $200.7 billion, according to the most recent state report issued in April 2024, New Jersey is the fourth-highest among all states in the level of gross tax-supported debt, behind California, New York and Massachusetts. New Jersey also ranked fourth-highest in per-capita debt, behind Connecticut, Massachusetts and Hawaii, and fourth-highest in debt as a percentage of gross-domestic product, behind Connecticut, Hawaii and Massachusetts. State and local government debt service as a share of tax revenue was 4.41% in 2022, ranking New Jersey as 17th highest of all states. New Jersey also has the second-worst bond ratings of any state, behind only Illinois, with bonded debt and the state’s large unfunded pension liability routinely cited as important factors by credit analysts such as Moody's and Standard & Poor's. * Governor's Budget Message, Fiscal 2025 (7/1/2024-6/30/2025) * USGovernmentSpending.com * State of New Jersey Debt Report, Fiscal Year 2023, NJ Department of Treasury * RichStatesPoorStates.org * Government Credit Rating, USNews.com -- Taxes The overall tax burden (taxes as a percentage of personal income) on New Jersey residents was 9.47% in 2024, ranking 9th highest of all states and led by the 12.02% in New York, according to the annual survey published by WalletHub.com. The state ranked third of all states, however, in its property tax burden with 4.59%, behind only Maine (4.86%) and Vermont (4.85%). The statewide average property tax was $9,490 in 2022—an increase of slightly more than 2% over 2021, according to official data from the Department of Community Affairs. The nonprofit Tax Foundation’s State Business Tax Climate Index ranked New Jersey as having the worst business tax climate of all states in 2024, stating that it "... is hampered by some of the highest property tax burdens in the country, has the highest-rate corporate income taxes in the county, and has one of the highest-rate individual income taxes. Additionally, the state has a particularly aggressive treatment of international income, levies an inheritance tax, and maintains some of the nation’s worst-structured individual income taxes." * 2023 Tax Burden by State, WalletHub * Facts & Figures 2024: How Does Your State Compare?, Tax Foundation * 2024 State Business Tax Climate Index, Tax Foundation Government

* Governor * Legislature * Courts * Counties * Municipalities * Taxes * Politics/elections * Political history * Lobbyists |

|